Private Membership Association

TABLE OF CONENTS

(A) PMA FOUNDING Presentation:

1) What a PMA is ?

2) Why is it Different ?

3) How Do You Benefit ?

(B) Documents needed

1) CONSTITUTION

2) TRUST

3) CONTRACTS

(a) GRANTOR

(b) BENIFICIARY

(c) TRUSTEE

(d) MANAGER

(e) SERVICE PROVIDER

(C) Access to Capital – PMA Investing

(D) Conflict Resolution – PMA Courts

(E) Decentralized Network – PMA HUB

(F) Conclusion and Next Steps

_________________

(1)

What is a PMA

A Private Membership Association (PMA) is a group of individuals, Men and Woman, who have come together based on shared interests, goals, or values, and who operate within a private, rather than public, framework. PMAs establish their own rules and regulations, and membership is typically selective, with individuals invited to join based on specific criteria. They often operate with a focus on privacy and autonomy, providing services or benefits exclusively to their members.

PMAs claim autonomy from government regulation, particularly for internal operations, as long as they do not pose a “clear and present danger of substantive evil” to society, such as serious harm to public health or safety. “DO NO HARM” is the foundational principle of Natural Law and PMAs follow this lawful path.

PMAs operate primarily through private contracts, which define the relationship between the association and its members. These contracts, rather than common law or statutes, serve as the authority for governance, membership rights, and operational rules. For example, a PMA might establish a membership agreement that outlines benefits, responsibilities, and dispute resolution, all within a private domain. This approach is protected under law, with many Court decisions supporting the right to associate privately, without government interference, as long as activities do not endanger public welfare. One has a basic divine right to freely associate or disassociate with whomever we wish. DO NO HARM is the basic guard rails of lawful autonomy.

The legal basis for this autonomy is further supported by the principle that “no state can make a law that impairs the obligation of a contract,” ensuring PMAs can transact in goods and services that might be regulated in the public domain, provided they have proper documentation. This flexibility is particularly appealing for businesses seeking to avoid licensing headaches, marketing restrictions, and other regulatory burdens.

However, it’s important to acknowledge ongoing legal debates. Courts may scrutinize PMAs. To mitigate risks, PMAs must maintain clear documentation, such as bylaws and contracts, and ensure operations remain truly private, avoiding public-facing services that could invite scrutiny. The State always assumes everything is legal, and falls within the ill defined Public realm unless positively shown otherwise.

The core difference between Private Membership Associations (PMAs) and Public Bodies lies in their origin, purpose, legal framework, accountability, and the nature of their membership.

Let us breakdown and expand the concepts:

Private Membership Associations (PMAs)

a) Origin and Purpose: PMAs are private entities formed by individuals who voluntarily come together based on shared interests, beliefs, or a common purpose. Their primary goal is to serve the interests of their members.

b) Legal Framework: PMAs operate under common law principles and fundamental rights such as the freedom of association. They establish their own rules, bylaws, and contracts that govern the relationship between the association and its members.

c) Membership: Membership is typically selective and not open to the general public. Individuals must meet certain criteria and be approved to join.

d) Accountability: PMAs are primarily accountable to their members. Their governance structure is determined by their internal rules, often involving a board of directors elected by members.

e) Regulation: PMAs often assert a degree of autonomy from government regulation, particularly concerning their internal operations and the services they provide to their members, as long as they do not pose a “clear and present danger of substantive evil” to society. However, they are still subject to general laws, such as criminal law, anti-money laundering laws, and laws prohibiting fraud.

f) Privacy: PMAs generally offer a higher degree of privacy and confidentiality for their members and the association’s activities.

Public Bodies

a) Origin and Purpose: Public bodies are formally established organizations that derive their existence and authority from statutes enacted by a legislature (government). Their primary purpose is to serve the vaguely defined public interest and provide public or government services to the entire community within their jurisdiction.

b) Legal Framework: Public bodies operate under a vast array of public laws, regulations, and statutes. They are created and empowered by legislation.

c) Membership/Constituency: Their “membership” is effectively the public or citizens they are mandated to serve. Services are generally available to anyone within their defined scope. I is assumed everyone is the Public until proven otherwise.

d) Accountability: Public bodies are accountable to the government that created them and, ultimately, to the vaguely defined public they serve. They are typically subject to oversight mechanisms, transparency requirements (like freedom of information laws), and often have public representation on their governing boards.

e) Regulation: Public bodies are heavily regulated by government at various levels (federal, provincial/state, municipal). Their operations, funding, and decision-making processes are subject to stringent legal requirements.

f) Transparency: Public bodies are generally subject to greater transparency requirements, including public meetings, public records, and disclosure of information. Recently Protection of Privacy laws have created a veil whereby it is almost impossible to acquire information because it would be a violation of someone’s privacy.

Remember, PMAs are private groups formed by individuals or businesses with shared interests, operating under their own rules and contracts rather than public laws. They offer a way for businesses to maintain autonomy and serve their members exclusively, which can be appealing for innovative or niche ideas.

(a) Private Nature: PMAs are distinct from public entities because they operate within a private domain, governed by their own rules and agreements, rather than public laws and regulations. Confidentiality: PMAs offer a higher degree of privacy for members and their activities, protecting sensitive financial and business records. This is particularly valuable in industries where confidentiality is critical, such as health and wellness or legal services.

(b) Selective Membership: Membership in a PMA is not open to the general public. Instead, it is typically by invitation or based on meeting specific criteria established by the association’s Founders, Members or Foundational Documentation.

(c) Focus on Shared Interests: PMAs are formed around a specific purpose, such as professional development, social activities, or specific services.

(d) Privacy and Autonomy: PMAs prioritize member privacy and autonomy, often offering a more private and non-regulated environment for their activities.

Examples:

PMAs can take many forms, including:

- Professional Athlete Associations (golf, tennis, rowing, etcetera);

- Professional Associations (BAR, Hair Dresser, AMA);

- Political Parties (Liberal, Conservative and Green Party);

- Social Clubs (Private Bars, Private Clubs, Gentleman’s Clubs)

- Health Cooperatives (Private Gym, Private Saunas, Cooperative), and

- Educational Groups (Private Academy, Private School, Military School).

In essence, a PMA provides a framework for individuals to come together, define their own rules, and operate in a way that prioritizes their shared interests and values, often with a focus on privacy and autonomy.

Financial Advantages: PMAs can increase profits through unrestricted structuring and strategies not available to public domain businesses, such as no tax burden and reduced compliance costs. They also offer greater security in a world of changing laws and politics, ensuring long-term sustainability.

Real World Examples:

a) Professional Associations: The American Bar Association (ABA) and American Medical Association (AMA) claim to provide – networking, advocacy, and resources exclusively to members, operating with significant autonomy. For example, the AMA claims to advocate for healthcare professionals and patient care, offering training and policy influence.

b) Business and Trade Organizations: The National Federation of Independent Business (NFIB) claims to represent small businesses, providing legal support and lobbying efforts. The Young Presidents’ Organization (YPO) claims to connects business leaders for peer learning and collaboration, both operating under PMA structures.

c) Health and Wellness Associations: Organizations like the Life Extension Foundation and Optimum Health Institute claim to offer members access to healthcare programs and wellness retreats, maintaining privacy and flexibility outside public regulations.

(2) Why Is It Different?

A Private Membership Association (PMA) differs from a corporation in its structure, legal framework, and operational approach. PMAs are voluntary associations with a focus on private agreements among members, while corporations are formal entities with a defined legal structure and public obligations. PMAs prioritize member autonomy and self-governance, whereas corporations are subject to extensive regulations and oversight. Here’s a more detailed comparison:

Private Membership Association (PMA):

a) Structure: PMAs are less formal, relying exclusively on Private Natural Law (Do no Harm) Contracts, internal agreements and bylaws among members.

b) Legal Framework: PMAs operate under private contracts between members, offering more flexibility and autonomy compared to corporations.

c) Purpose: PMAs can serve various purposes, such as resource sharing, cause promotion, or collective bargaining.

d) Membership: PMAs involve a voluntary association of individuals or businesses united by a common goal.

e) Governance: Members often have more control and influence over decisions within the PMA.

f) Regulations: PMAs operate with more flexibility, as they are not subject to public regulations which corporations are subject to.

g) Privacy: PMAs can offer a greater degree of privacy and confidentiality to their members.

h) Taxation: PMAs are not taxable so they have no tax burden.

Corporation:

a) Structure: Corporations have a formal structure with specific legal requirements for bylaws, shareholder meetings, and record-keeping.

b) Legal Framework: Corporations are governed by Federal, State and Municipal laws, requiring compliance with numerous regulations.

c) Purpose: Corporations typically focus on generating revenue and profit for their shareholders.

d) Membership: Corporations can have numerous shareholders, who may or may not be actively involved in the company’s operations.

e) Governance: Corporations have a hierarchical structure with a board of directors and officers who manage the company’s affairs.

f) Regulations: Corporations are subject to extensive government regulations and oversight by Federal, State and Municipal regulators.

g) Privacy: Corporations operate in the public domain and are subject to public disclosure requirements.

h)Taxation: Corporations are subject to corporate income tax, Federal Tax and State Tax, which is separate from the individual income tax of its shareholders.

3) Benefit to PMA Founders, Managers and Members

A Private Membership Association (PMA) offers potential advantages over a corporation, particularly in terms of lack regulatory burden, lack taxation burden and a sense of community. PMAs can operate with greater autonomy, establishing their own rules and governance structures, while corporations are subject to a wider range of public regulations. However, PMAs may also face challenges related to legal ambiguity and membership management. Here’s a more detailed comparison:

Private Membership Associations (PMAs):

• Regulatory Flexibility: PMAs can operate with more freedom from public regulations, as members enter into private Lawful contracts that define their association, obligations and benefits.

• Community Focus: PMAs foster a strong sense of community, exclusivity, and belonging among members due to their selective nature.

• Autonomy and Control: Members often have more control over the association’s direction and decision-making processes.

• Privacy and Confidentiality: PMAs can offer a higher degree of privacy and confidentiality compared to public corporations.

• Potential for Financial Advantages: Some PMAs may offer financial benefits to members, such as reduced service costs or access to exclusive deals.

• Potential for Legal Ambiguity: PMAs may operate in legal grey areas, and their specific rights and obligations may not always be clearly defined.

Corporations:

• Legal Capacity: Corporations are recognized as legal entities, capable of entering into contracts, owning property, and suing or being sued.

• Limited Liability: Shareholders in a corporation generally have limited liability, meaning their personal assets are protected from business debts and lawsuits.

• Centralized Management: Corporations have a clear management structure, typically with a board of directors and officers.

• Access to Capital: Corporations can raise capital by issuing shares of stock, making it easier to fund expansion and operations.

• Regulatory Compliance: Corporations are subject to a wide range of regulations and reporting requirements at the local, state, and federal levels.

• Taxation: Corporations are subject to corporate income tax, and shareholders may also be taxed on dividends they receive.

How to Structure a PMA

To form a PMA, businesses can follow these steps:

1. Define Purpose and Goals: Clearly outline the shared interests or objectives, such as serving a specific industry niche or providing specialized services.

2. Draft Bylaws and Membership Agreements: Establish internal rules, member rights, and responsibilities, ensuring all operations are governed by private contracts.

3. Establish Selective Membership: Implement an application and approval process to ensure like-minded individuals or businesses join.

4. Option – Form a Governing Board: Elect a board of directors to oversee operations, ensuring member input in decision-making.

5. Ensure Compliance with Private Governance: Maintain documentation to demonstrate the association’s private nature and avoid public-facing activities that could invite scrutiny.

Benefits for Your PMA Business Idea.

For your business, a PMA could mean:

– Flexibility: Operate with no government regulations, allowing for insightful approaches, be on the very edge of creativity, originality and entrepreneurship. This is where the excitement is.

– Privacy: Protect sensitive business ideas and member information, enhancing trust. Be completely discreet, exclusive and Sovereign.

– Community: Build a loyal, exclusive network of like-minded members, boosting collaboration and growth.

Key Differences:

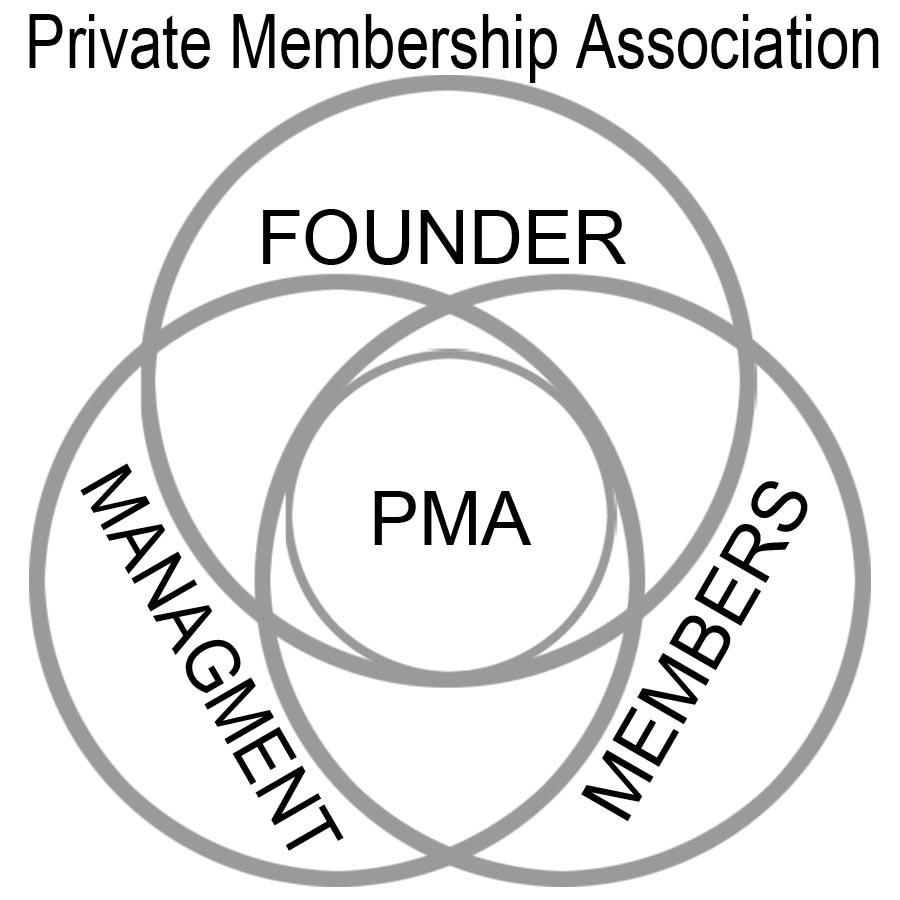

The main distinction between a PMA and a corporation lies in their legal structure and the extent of public regulation they are subject to. PMAs operate under lawful private agreements, allowing for greater autonomy and flexibility, while corporations are established under public law and are subject to a broader range of regulations, taxation and oversight. A PMA is made of three main groups:

1) FOUNDER

2) MANAGERS

3) MEMBERS

1) FOUNDERS: The Founders are the original men and woman who create the PMA for a specific purpose and intent.

2) MANAGERS: The Managers are the one tasked with achieving the Goals of the PMA founding documents and make available all the benefits owed to the Beneficial Members

3) MEMBERS: These are the men and woman who sign up to receive the benefits offered by the PMA.

Documents:

(1)

CONSTITUTION:

A PMA’s constitution is a foundational legal document that outlines the rules governing the PMA’s internal management and the relationships between its Members, be they Directors, Managers and Beneficial Membership holders. It defines how the PMA operates, including how it is managed, how decisions are made, and the rights and obligations of its members. Here’s a more detailed breakdown:

Key Components and Purpose of the CONSTITUTION:

• Articles of Association: This is a crucial part of the constitution, detailing the rules for internal management, such as how meetings are conducted, how shares in resources are issued, and how Directors , Managers or other Agents are appointed.

• Resolutions and Agreements: Any resolutions or agreements that affect the PMA’s constitution are also considered part of it. This could include shareholder Member resolutions that amend the articles or agreements with specific terms.

• Governing Documents: The constitution essentially sets out the framework for the PMA’s governance, defining the relationship between the managing Personnel and its members.

• Contractual Relationship: The constitution creates a binding lawful contract between the members, meaning that the rules within it are lawfully binding on both the PMA Managers, Agents and the other Members.

In essence, the constitution is a set of rules that:

• Defines the PMA’s structure and operations.

• Establishes the rights and responsibilities of those involved in the PMA (Directors, Members, etc.).

• Provides a framework for resolving disputes and making decisions within the PMA.

Examples of what a constitution might include:

• Procedures for calling and conducting meetings.

• Rules for appointing and removing directors.

• Provisions for different classes of investments.

• Procedures for amending the constitution itself.

Why is it important?

• Clarity and Transparency: Provides clear guidelines for how the PMA operates, avoiding misunderstandings and disputes.

• Compliance: Helps ensure the PMA complies with intent of the Founding Documents.

• Investor Confidence: A well-defined constitution can increase investor confidence by demonstrating a clear and well-structured governance framework.

(2)

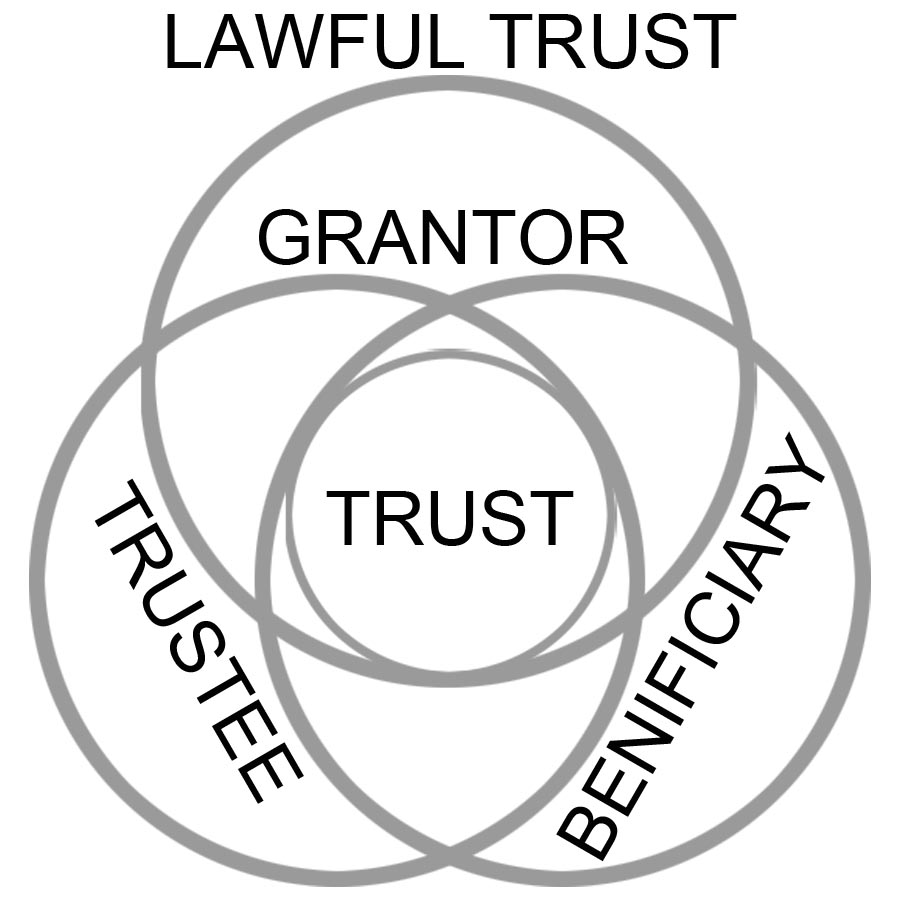

TRUST

A lawful Trust is a relationship where one party (the Grantor) transfers property to another party (the Trustee) to manage and control for the benefit of a third party (the Beneficiary). It’s essentially a way to hold assets for someone else’s benefit, with specific rules and obligations outlined in a trust document. Here’s a more detailed breakdown:

a) Grantor: The person who establishes the trust and transfers the property.

b) Trustee: The person or entity that manages the trust assets according to the trust document.

c) Beneficiary: The person or entity who benefits from the trust, receiving income or assets as outlined in the trust.

Fiduciary Duty: The Trustee has a legal and ethical obligation to act in the best interests of the Beneficiaries and manage the trust assets prudently.

Trust Document: This is a legal document that outlines the terms of the trust, including the Beneficiaries, the Trustee’s responsibilities, and how the assets should be managed and distributed.

Key TRUST Characteristics:

Separation of Legal and Beneficial Ownership: The Trustee holds legal Title to the assets, while the Beneficiary has the right to benefit from those assets.

Flexibility: Trusts can be created during the Grantor’s lifetime (inter vivos trust) or after their death (testamentary trust).

Purpose: Trusts can be used for various purposes, including managing assets for PMA’s.

(3)

CONTRACTS

A contract is a legally/lawfully binding agreement between two or more parties, creating mutual obligations that can be enforced by law. It involves an offer, acceptance, and consideration (something of value exchanged). Contracts can be written or verbal, but must meet specific requirements to be valid.

Here’s a more detailed breakdown:

Key Elements of a Contract:

• Agreement: There must be a “meeting of the minds,” where all parties understand and agree to the terms.

• Offer: One party proposes specific terms to another.

• Acceptance: The other party agrees to the offer’s terms without changes.

• Consideration: Each party provides something of value to the other, such as goods, services, or money.

• Intention to Create Legal Relations: Parties must intend for their agreement to be legally binding.

• Capacity: Parties must have the legal ability to enter into a contract (e.g., not be a minor or mentally incompetent).

Types of Contracts:

• Bilateral Contract: A promise is exchanged for a promise (e.g., a purchase agreement).

• Unilateral Contract: A promise is exchanged for an action (e.g., a reward for finding a lost pet).

Validity of Contracts:

• Contracts can be written or verbal, but written contracts offer more clarity and enforceability.

• Verbal contracts can be harder to prove if a dispute arises.

• Some contracts require specific formalities (like being in writing) to be valid.

Breach of Contract:

• If one party fails to fulfill their obligations (breaches the contract), the other party can seek legal remedies.

• These remedies can include specific performance (forcing the breaching party to fulfill the contract) or monetary damages.

(a)

GRANTOR

In a trust context, a Grantor typically refers to the one who is provide property for the use of the Trust, so that the Beneficiaries receive benefits from the Trust, whether those benefits are income, assets, or the use of Trust Property. The Grantor is the ultimate donator to the trust out of generosity, as outlined in the Founding Trust Document. More specifically this is an individual who donates property, money or legal rights without compensation.

In the context of Trusts, a Grantor is:

(1) the individual or entity that establishes the Trust and transfers assets into it;

(2) another individual or entity that transfers assets into the Trust after its creation;

The Grantor is also known as the Settlor, Trustor, or Creator of the trust (if they established the Trust). Essentially, they are the person who initially owns the assets and decides to place them under the management of a Trustee for the benefit of Beneficiaries. Here’s a more detailed breakdown:

a) Creation and Funding: The Grantor is the one who creates the trust document and transfers ownership of assets (like money, property, or investments) into the trust.

b) Trustee Appointment: The grantor typically appoints a Trustee to manage the trust assets and carry out the Grantor’s instructions as outlined in the Trust document.

c) Beneficiary Designation: The Grantor also specifies who will benefit from the trust (the Beneficiaries) and under what conditions the assets will be distributed.

d) Control and Revocability: In some Trusts (revocable trusts), the Grantor retains the power to modify or revoke the Trust during their lifetime. In others (Irrevocable Trusts), the Grantor relinquishes control and cannot change the trust terms.

e) Tax Implications: For income tax purposes, once the Grantor donates property to the Trust it is no longer considered his property for tax purposes, it is the property of the Lawful Trust.

(b)

BENIFICIARY

A Beneficiary in the context of a Trust is a person or entity who is entitled to receive benefits from the Trust, as defined by the Trust Document. These benefits can include income generated by the Trust’s assets, the assets themselves, or other advantages outlined in the Trust’s Terms. The Beneficiary is essentially the person for whose benefit the trust was created. Here’s a more detailed breakdown:

a) Trust: A legal arrangement where a Grantor transfers property to a Trustee, who manages it for the benefit of a Beneficiary.

b) Trustee: The individual or entity responsible for managing the Trust assets according to the Trust’s terms.

c) Beneficiary: The individual or entity that is entitled to receive the benefits of the Trust, such as income, assets, or other advantages.

Beneficial Interest: The right or entitlement of a beneficiary to receive a benefit from the trust.

For example, if a ‘Inheritance Trust’ is created for the benefit of a child, the child is the beneficiary and is entitled to receive the income or assets held in the Trust. The Trustee would manage the Trust assets and distribute them to the child according to the trust’s terms.

(c)

TRUSTEE

A Trustee is a person or entity entrusted with the responsibility of managing assets in a Trust for the benefit of one or more beneficiaries, as outlined in the trust document. They hold the legal Title to the Trust Property and are obligated to administer it according to the terms of the Trust, acting in the best interests of the beneficiaries. Key aspects of a trustee’s role:

a) Holding Legal Title: The Trustee has legal ownership of the Trust assets, but they are not the beneficial owner.

b) Fiduciary Duty: Trustees have a fiduciary duty to act in the best interests of the Beneficiaries, meaning they must prioritize the Beneficiaries’ needs and avoid conflicts of interest.

c) Administration and Management: Trustees are responsible for managing the Trust assets, which may include investing, distributing income and principal and maintaining records.

d) Following the Trust Terms: Trustees must adhere to the specific instructions and directions outlined in the trust document, including how the assets are to be managed and distributed.

e) Accountability: Trustees are accountable to the beneficiaries for their management of the Trust assets and can be held liable for Breaches of Trust.

In simpler terms, a Trustee is like a manager of a fund, but with a legal obligation to be honest and fair to those who benefit from the fund. The Traditional standard of Care and Diligence, required of a Trustee, in administering a Trust is that of a man of ordinary prudence in managing his own affairs

(d)

MANAGER

In a PMA, a Manager is an individual, appointed or elected, who is authorized to manage the affairs of a PMA, either wholly or substantially. This role can be filled by a board of directors (if there is one), but other individuals can be designated as Managers, depending on the specific structure of the PMA. Essentially, Managers are entrusted with the responsibility of overseeing the PMA’s short and long term operations and ensuring its efficient functioning. Here’s a more detailed breakdown:

a) Board of Directors: In many Large PMAs, the board of directors is the primary body responsible for managing the PMA’s affairs. They are elected by the Members and have the authority to make decisions on behalf of the PMA. In smaller PMAs, a Board of Directors is unnecessary.

b) Other Designated Individuals: While the board often leads, specific individuals may also be designated as Managers, such as a General Manager, a Chief Executive Officer (CEO), or other Officers with defined management responsibilities.

c) Nature of Responsibilities: Managers typically oversee daily operations, supervise staff, and make decisions related to the PMA’s activities. They are responsible for ensuring the PMA achieves its goals and operates within ethical boundaries according to its founding documents.

d) Distinction from Directors: While managers and directors may overlap, managers are generally more focused on the day-to-day execution of the company’s strategy, while directors are responsible for setting the overall strategy and ensuring its implementation.

(e)

SERVICE PROVIDER

A PMA Service Provider (PMASP), in a legal context, is generally defined as an individual or entity that provides services to a PMA, but is not a Member of the PMA, or otherwise directly involved in the PMA’s ownership or management. They are essentially third-party service providers contracted to perform specific tasks or functions for the PMA. Here’s a more detailed breakdown:

• Third-Party Relationship: PMASPs are distinct from members of the PMA. They are separate entities providing services under a contract or agreement. This may be goods, services or otherwise something of value, sought by the PMA.

• Specific Services: The services offered by PMASPs can vary widely, encompassing areas like legal, accounting, IT, marketing, or other specialized functions.

• Contractual Agreement: The relationship between the PMA and the SP is typically governed by a service agreement or contract that outlines the scope of work, fees, and other relevant terms.

• No Ownership Stake: PMASPs generally do not have an ownership stake or equity in the PMA they are providing services to.

• Examples: Common examples include marketing agencies, web hosting platforms, software service providers, and consultants.

In essence, a PMA service provider acts as an external resource, offering specialized expertise or support to the PMA without being part of its internal structure.

(C)

Access to Capital

Access to Capital: Corporations can raise capital by issuing Bonds or issuing shares of stock, making it possible to fund advertising, expansion and operations. PMA have to raise capital in different ways. A PMA HEDGE FUND can accomplish this task, without complication.

A PMA HEDGE FUND is a PMA specific Fundraising vehicle that is used to acquire investment capital to specifically invest in PMA’s to grow their business. The PMA HEDGE FUND sells bonds for a set time frame with a low risk of loss. The subject Bonds are spread across low, medium and high risk investment opportunities, spreading the risk, so that set Returns are almost guaranteed.

Establishing a PMA open access to these Investment Funds.

(D)

Conflict Resolution – PMA Courts

We will have our own PMA Private Courts to resolve disputes that arise within the PMA decentralized network.

(E)

Decentralized Network – PMA HUB

The PMA HUB will help to coordinate resources, between diverse PMA enterprises. Maximizing Resource distribution and coordinating expansion. Economies of scale is achieved by many people investing together in a coordinated way.

(F)

Conclusion and Next Steps

In conclusion, experience, research and common sense suggests PMAs offer autonomy, flexibility, privacy, and exclusivity, making them an ideal structure for businesses seeking to operate outside traditional regulatory frameworks. By relying on private contracts and constitutional protections, PMAs provide a legally sound way to achieve business goals. For your business idea, consider forming a PMA to gain control, reduce compliance burdens, and build a loyal community.

One can do the research and create a PMA on their own, the information is out there, or one could acquire Services of ELEGANT PMA CONSULANTS. We will do it all,